13 Best PayPal Alternatives for 2023

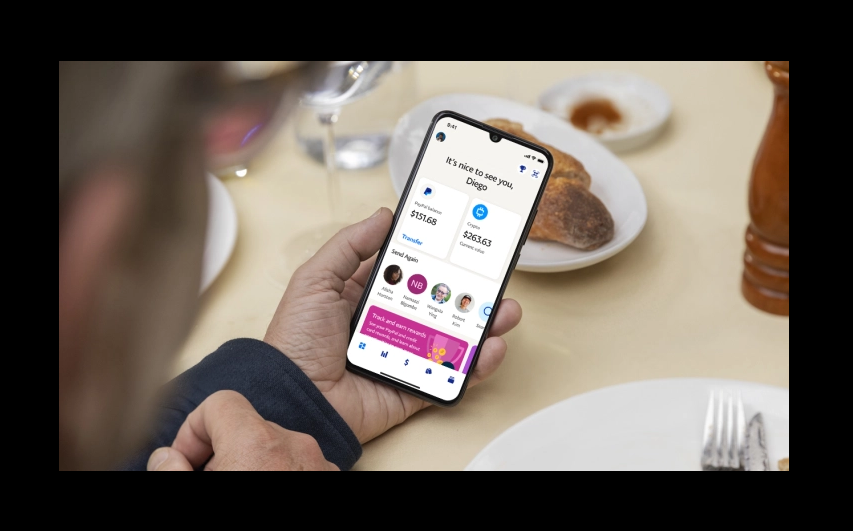

PayPal allows businesses to process payments, even for customers without a PayPal account. This is incredibly easy to use and operate. There are several reasons why you should consider this option. However, PayPal’s point-of-sale system technology is limited in comparison to others. While PayPal offers a variety of payment systems, many providers, including Stripe, have specialized online services to help you personalize the online process. Also, several payment processing companies charge lower fees than PayPal.

PayPal Alternatives: Online payments challenging rivals

BlueSnap

For IT professionals who want an online platform for payment processing and payment, BlueSnap offers an online payment gateway for eCommerce that provides customers with downloadable products and services and e-commerce services. It is one of the PayPal Alternatives, It supports 100 currencies and a wide variety of languages. Blue Snap offers an API for customizing checkout pages and creating subscription packages. This PayPal alternative includes virtual terminals and functionality specifically designed for payments via the marketplace. The software offers an automated chargeback recovery process, fraud reduction, and reporting.

PayPro Global

PayPro Global is a complete eCommerce solution, providing a wide range of services to businesses that want to sell digital products online. These services include payment processing, fraud protection, product delivery, and customer support. PayPro Global is a PayPal Alternative that also offers a merchant of record service, which allows businesses to outsource the management of online payments. This allows developers to focus on other aspects of their operations, such as product innovations and marketing. PayPro Global is based in Toronto, Canada.

Stax (formerly Fattmerchant)

This option is best for high-volume eCommerce companies that require subscription payments at low rates. Similar to other list items, Stax provides QuickBooks support for QuickBooks. Although the company charges monthly payment fees, the fee is priced to match the actual cost of the transaction. The solution is especially attractive for businesses with high sales volume. Prices – Interchange rates minus processing mark-off per transaction. Growth plans cost $199 a month. Pro Plans are $299 a month. Ultimate Plans are $199 a month.

WePay

Designed to be used as a payment service on a hosted server by businesses, WePay, unlike many alternative PayPal options listed below, can be tailored to the needs of business users that are using software platforms to allow their users to make payments by email. WePay is another PayPal altrnative which provides a scalable payments solution that is hosted on your platform without the need for any third-party processor. Our payments are controlled by Bank of America. Pricing: 2.55% + 25 cents on cash transactions with WePay Link, which is the standard package choice.

Braintree

For online businesses wanting PayPal features or capabilities but with dedicated merchant accounts, Braintree’s products and services are different. Although PayPal offers a limited merchant account aggregated, Braintree offers a separate merchant account. With an individual merchant account, your account may be frozen or terminated less often. You can also use mag-tripe cards for contactless payments, as well as convert 130 currencies. Pricing: 2.59% plus 49 cents on transactions using credit or debit cards.

Payline data

This is best for companies seeking affordable and integrated merchant service providers, PayLine Data offers reliable, low-cost payment solutions for merchant customers. The company has also added additional functions that allow you to receive cards on an internet connection. Its pricing represents 4% and 10% of the total amount in the person transaction, and 10 dollars monthly. The exchange fee is 0.75% and $20 per transaction on the Internet. The price of each type of prepaid credit card is varying according to the type of transaction.

Adyen

This PayPal alternative is best for online businesses that accept orders through various channels; the customer must create their own account. Several major tech companies such as Spotify and Etsy use Adyen to process their online payments. Subscribers are allowed to pay through their online accounts using security measures. These features attract small companies that want to take payments through several sales channels. Its prices are changing, plus twelve dollars for Master Card and Visa, and some methods vary.

Amazon Pay

This option is suitable for American online businesses with a website that uses the Internet and businesses with eCommerce accounts with Amazon. Amazon Pay provides a payment platform that enables customers to pay online through an Amazon account. This plug-in can integrate directly with your existing eCommerce system. It supports eCommerce platforms including Bigcommerce and Shopify. Its pricing is 2.9% + 20c for internet and mobile purchases. 4% plus 5% on Alexa transactions, plus an extra 11% of the transaction.

Stripes

Stripe provides online payment services through Amazon and Google. Moreover, it offers a flexible way to customize the payment according to the customer’s needs. The additional functionality includes the capability to create reports, billing reports, and invoices for clients and customers. The prices are 2.9% + 30c for online transactions, 5% plus 5 cents on a transaction by telephone, 3.4% plus 30 cents for the automatic keying transaction, and 3.7% plus 30 cents for foreign cards and foreign currency.

Square one

It best suits businesses looking for the most efficient and complete payment system. Square has a much higher popularity than PayPal. It also offers payment processor services, including accepting magnetic stripes, chips, and contactless payment methods. A further offering is Square Magstripe Reader Square Register. Its free software is regarded as a good PayPal alternative to POSs. The pricing is 2.6 % plus 10 cents for online sales (2.7% plus 10 cents for Retail Plus plans).

QuickBooks GoPayment

QuickBooks users who want integrated mobile payment systems. GoPayment from QuickBooks provides an easy way to sync QuickBooks with your Accounting Software. Clients have the option to integrate with QuickBooks Card reader. The QuickBooks Payment system only supports businesses using QuickBooks as an accounting tool. The prices are 24% plus 25 cents per person. 2% excluding tax. The total amount will be based on an online invoice.

Shopify Payments

When a website uses Shopify payments, it is advisable. It provides several payment modes and competitive processing rates, although it is not offered in every country and is not suitable for businesses in some high-risk industries. Its pricing is 2.8%, 2.6%, or 3.9% with a 30-cent charge

on the online payment option on the Advanced, Shopify Basic Plans. 2.4% / 25% / 26% of payments are made on advanced, Shopify, and basic plans.

Charge.com

For Businesses that want fast processing with specialized merchant accounts, Charge.com is a suitable option. It provides merchant accounts that enable small businesses to accept payments through cards, virtual machines, or online stores. This product does not feature additional capabilities but provides an economical, easy payment system. Its pricing starts at 14% plus 15 cents per transaction.

Conclusion

When it comes to choosing a payment processor, there’s no one-size-fits-all solution. The best PayPal alternative for your business depends on your specific needs and preferences. We hope this article has helped you narrow your options and choose the right provider for your business.

Alexia is the author at Research Snipers covering all technology news including Google, Apple, Android, Xiaomi, Huawei, Samsung News, and More.