Digital Euro meets resistance: Europeans are skeptical

The European Central Bank is pushing ahead with the introduction of a digital euro, but resistance is growing in Germany. Concerns about data security and possible technological dependencies are causing many citizens to doubt.

What is behind the fears? The European Central Bank (ECB) is pushing ahead with the development of a digital euro, but is encountering considerable skepticism, particularly in Germany. How Bloomberg reports around half of Germans cannot imagine using the digital currency. The reasons for this are varied and deeply rooted in German history and mentality.

Data protection as a primary concern

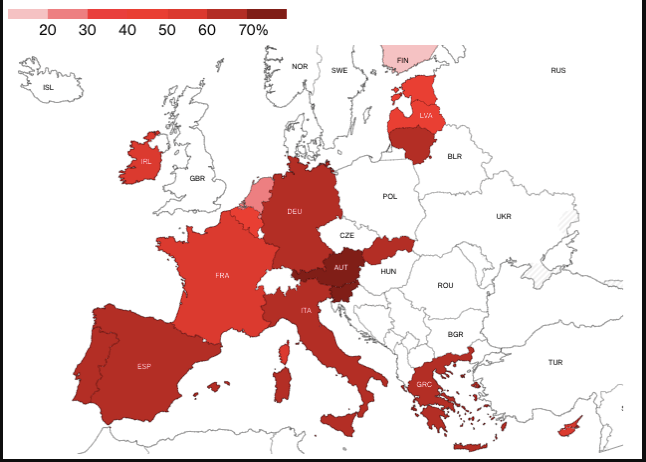

The biggest concern for Germans is data protection. At a time when digital security is increasingly in focus, many fear that their financial transactions may not be adequately protected. These concerns are particularly pronounced in Germany – more so than in other major Eurozone economies.

The ECB is aware of these concerns and plans to implement advanced security measures. These include techniques such as data encryption and hashing to prevent a direct link between transactions and specific users. Whether these measures will be enough to convince skeptical Germans remains to be seen.

Technological dependence as a risk

Another point of criticism is the potential technological dependency that a digital euro could bring with it. Many Germans, especially older generations, see the danger that a failure of the digital infrastructure could have serious consequences for payment transactions.

This concern is exacerbated by the Germans’ strong affinity for cash. Joachim Nagel, President of the German Bundesbank, even describes cash as “sacred” for many Germans. This attitude is also reflected in the fact that Germany is still one of the countries with the highest cash usage compared to other European countries.

Generational differences in acceptance

Interestingly, there is a clear generational difference in the acceptance of the digital euro. Younger Germans tend to be more open to the new technology and less concerned about their privacy in the digital space. A study found that only 10 percent of 18- to 24-year-olds would refuse to disclose personal data online in order to improve service quality. Among those over 65, the figure is this proportion is one third. ECB President Christine Lagarde stressed in October 2023 that the digital euro is intended as a digital form of cash that can be used for all digital payments and should exist in parallel.

Challenges for implementation

The introduction of the digital euro faces considerable challenges. A report by the Federal Association of German Volksbanks and Raiffeisenbanks (BVR) commissioned study concludes that the digital euro in its currently proposed form offers little added value for consumers and trade. The complexity of the system could lead to problems of understanding and low usage.

The digital euro in the form currently envisaged would be more of a competing product for existing cashless payment methods and less of an innovative replacement for the traditional central bank product of cash, the use of which is currently declining. Professor Dr. Malte Krüger, Aschaffenburg University of Applied Sciences

Complexity and feasibility

The study shows that the number of parties involved in the payment process could increase from the current four to up to eight, which would complicate and slow down the processing processes. In addition, there are still open questions about the design of the compensation model, the regulation of liability issues, the design of the offline digital euro, the level of the holding limits, and the design of a planned digital euro card.

We are committed to a digital euro that offers consumers and companies clear added value. The proposals made so far by the Eurosystem and the EU Commission to create a state-run parallel world to the existing and proven private sector payment system are the wrong way to go. Tanja Müller-Ziegler, BVR board member

International perspective

Skepticism about central bank digital currencies (CBDCs) is not limited to Germany. In the US, politicians, especially from the right-wing spectrum, have spoken out against a digital dollar. Former President Donald Trump has even announced that he will oppose CBDCs if he is re-elected in 2024, as he considers them “very dangerous” due to possible government overreach.

Outlook and next steps

The ECB plans to make a final decision on the introduction of the digital euro at the end of 2025. Until then, it is important to take the concerns of citizens, especially in Germany, seriously and find adequate solutions. Transparent communication and the involvement of all stakeholders will be crucial to building trust in the new form of currency. Despite all the skepticism, there are also voices in Germany that see opportunities for the digital euro.

Hans Heinrich Kloeppel, a pensioner from Cochem, told Bloomberg: “You can’t close your eyes to it. You have to adapt to such new developments.” This openness could be the key to convincing even skeptical citizens of the advantages of a digital euro. What do you think about the introduction of a digital euro? Do you see more opportunities or risks?

Alexia is the author at Research Snipers covering all technology news including Google, Apple, Android, Xiaomi, Huawei, Samsung News, and More.