Who hasn’t dreamed of the ATM spitting out too much money? But it does not happen that such machines are wrong. Always? No, not always, as some Irish bank customers recently discovered. But that was not without consequences.

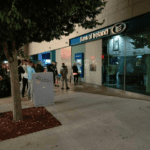

Long queues formed outside Irish ATMs yesterday. According to a BBC report, a technical glitch has enabled some Bank of Ireland customers to withdraw large amounts despite having little or no money in their accounts. There were numerous photos and videos of long queues in front of ATMs on social media like X.

The financial institution confirmed the problems, which, according to the Bank of Ireland, had already been resolved on Wednesday morning. “We are aware that the technical issue has resulted in some customers being able to withdraw or transfer funds beyond their normal limits,” the bank said through a spokeswoman.

As tempting as the thought was of being able to “just like that” get money from the machine – they can’t keep it and one can only hope that the supposedly “lucky ones” haven’t already spent it. Because the bank also let it be known that “these transfers and withdrawals are now booked on the customers’ accounts”.

The bank representative said: “We ask all customers who have encountered financial difficulties due to an overdraft on their account to contact us.” However, the consequences could also be serious in the long term.

Because as the Irish Times writes, unplanned withdrawals could have long-term consequences, namely when the accounts are overdrawn and the individual customers cannot return the money immediately. In concrete terms, a person’s creditworthiness suffers (via the Irish counterpart to Schufa) if the money cannot be repaid in the long term.

Digital marketing enthusiast and industry professional in Digital technologies, Technology News, Mobile phones, software, gadgets with vast experience in the tech industry, I have a keen interest in technology, News breaking.