Digital Gold Rush: The Rise, Fall & Resurgence of Cryptocurrencies

Exploring any top cryptocurrency reveals a modern-day gold rush, filled with excitement and promise for countless investors. It all kicked off with Bitcoin, a revolutionary yet subversive idea that has blossomed into a global financial spectacle. The aptly coined phrase “Digital Gold Rush” captures the rapid move towards digital money. The story of cryptocurrency is more than a financial change; it showcases human creativity and the desire for more financial freedom.

To illustrate this boom, since 2010, Bitcoin’s market cap has increased by over 2 million percent, and its price increased from less than a dollar to over USD 50,000, illustrating the meteoric rise of digital currencies in the past decade.

The Genesis and Journey of Cryptocurrency

The spark that kindled the crypto revolution was the birth of Bitcoin. Satoshi Nakamoto, the elusive entity behind Bitcoin, unveiled a blueprint for a decentralised digital currency in a 2008 whitepaper. The mining of the Genesis Block in 2009 signaled a new era of decentralised digital transactions. Despite sparse initial adoption, Bitcoin’s potential as a financial disruptor was evident even in its earliest stages. Bitcoin’s impact on the financial landscape of cryptocurrency market prices has since been truly substantial. As of February 2023, the global cryptocurrency market cap was USD 2.3 trillion, with Bitcoin’s market cap at USD 444 billion, showing a dominance of 41.14%. As of the end of September 2023, Bitcoin’s market dominance stands at 41.3%, indicating its continued significance in the cryptocurrency market despite the rise of numerous altcoins.

After Bitcoin’s initiation, alternative cryptocurrencies (altcoins) like Ethereum and Litecoin emerged, each bearing unique objectives and functionalities. These cryptocurrencies augmented the original Bitcoin premise with fresh layers of innovation, broadening blockchain technology’s scope and application. Ethereum, the second-largest cryptocurrency by market capitalisation, reached a new all-time high of USD 4,362 on May 12, 2021, demonstrating the potential of alternative cryptocurrencies.

The crypto journey has witnessed further monumental milestones. The inception of numerous cryptocurrency exchanges, catalyzed by Bitcoin’s initial transactions, laid the foundation for a burgeoning crypto economy. A colossal crypto boom in 2017 catapulted cryptocurrencies from obscurity to the financial limelight.

“The proliferation of altcoins represents a democratisation of the blockchain space, giving rise to innovative solutions beyond Bitcoin’s original proposition,” says blockchain expert Kostas Alekoglu.

The Roadblocks: Security, Scalability, and Regulation

The ascent to crypto prominence has certainly been full of major impediments. Foremost are security concerns, amplified by crypto hacks and thefts, such as the now infamous FTX scandal. In 2022, losses from crypto-related fraud and theft topped USD 3.2 billion, a 57% increase from the previous year’s USD 2 billion. These have raised endless concerns regarding the robustness of the security infrastructure behind cryptocurrencies. The allure of privacy and anonymity, while a boon to many, also brings its set of challenges.

Discussions surrounding blockchain scalability and the hurdles for less tech-savvy individuals further underscore issues, specifically looking at the gap between complex technology and user-friendliness in this context. This chasm, yet to be fully bridged, poses a significant challenge to mainstream adoption. Interestingly, 61% of American crypto investors are men, while 39% are women, reflecting a gender gap in the crypto realm.

Lastly, interactions with global regulatory frameworks represent a nuanced dance that often hits a brick wall. Initial reactions from regulators were mixed, and evolving regulations continue to impact cryptocurrency adoption and valuation substantially. This is especially clear in the US, where, under the leadership of Gary Gensler, the SEC has increased its enforcement actions targeting individuals, with the rate rising to 50% in 2022 from 20% during 2013-2020. The global regulatory vista, with varied stances towards crypto across jurisdictions, molds market dynamics and steers the trajectory of cryptocurrencies. Nearly two-thirds of the countries reviewed are in the process of making substantial changes to their regulatory framework regarding cryptocurrency markets, often through new and bespoke legislation.

The Renaissance: DeFi, NFTs, and Mainstream Adoption

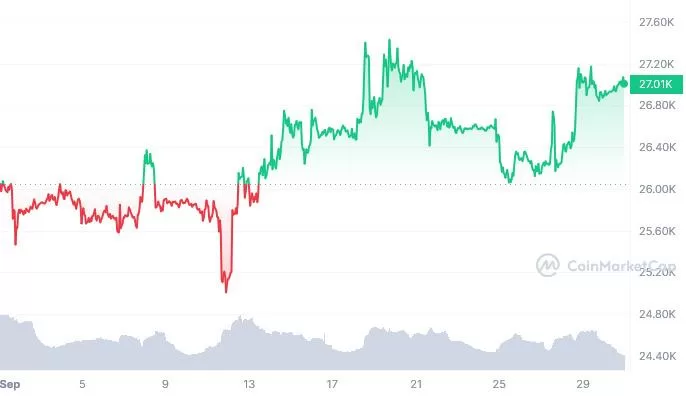

Bitcoin’s drop is evident in June 2021, yet the resurgence is clear. Another drop occurred, however, it is steadily climbing again.

While a range of factors underpins the resurgence of cryptocurrencies post-COVID-19, the ascent of Decentralised Finance (DeFi) and Non-Fungible Tokens (NFTs) exemplifies the relentless innovation within this domain. Gradual mainstream acceptance has signaled a new chapter in the crypto narrative. As of September 2023, the total value locked (TVL) in DeFi protocols is $96.8 billion, and the NFT market witnessed a trading volume of over $10.7 billion in the first half of 2021.

The DeFi realm, aiming to recreate traditional financial services on blockchain technology, and the NFT surge, offering unique digital assets verifying ownership, are pioneers of this new era. These innovations are not only diversifying the crypto landscape but are propelling it toward a semblance of maturity and mainstream acceptance.

“The meteoric rise of DeFi and NFTs showcases the ever-evolving nature of the crypto space, each bringing a unique value proposition and broadening the horizon of what’s possible on the blockchain,” remarks tech analyst Adrian Black.

Spotlight: Emergent Markets and the Future Horizon

ISLAMI coin’s price for Oct-Nov 2023

The above, paired with emerging markets in multiple regions, signals a true resurgence for cryptocurrencies. The crypto market in the Arabic regions specifically, illustrated so well by Nusur al Crypto, is a thriving frontier filled with opportunities. With potentially major cryptocurrencies such as ISLAMI Coin looking promising, the scene is exciting. The evolving regulatory environment in Arab nations is gradually shaping the crypto landscape in this region, opening doors for innovation and investment. The Middle East has witnessed an accelerated pace of change, with the United Arab Emirates (UAE) and Saudi Arabia at the forefront of this transformation. The UAE, for instance, is home to over 60 crypto trading platforms, indicating a significant adoption and nurturing of cryptocurrency within the region.

These changes in the region, with their economic powerhouses increasingly adopting and nurturing cryptocurrency, are forecasting a significant contribution to the region’s overall growth and development in the coming years.

Looking beyond, the horizon of cryptocurrency’s future is laden with potential. The evolving regulatory frameworks, groundbreaking technological advancements, and the perpetual state of innovation promise an exhilarating, albeit challenging, journey ahead. The allure of the crypto realm, especially within emerging markets, invites a deeper exploration into this enthralling digital frontier. As the crypto chronicle unfolds, it continues to beckon individuals and institutions alike to join in the vast, intricate, and ever-evolving domain of digital assets.

Alexia is the author at Research Snipers covering all technology news including Google, Apple, Android, Xiaomi, Huawei, Samsung News, and More.