Predictive Analytics and Immediate Edge: Unlocking Market Trends and Volatility

In a world that thrives on data, the concept of predictive analytics and Immediate Edge has transformed into an invaluable tool for understanding future market trends and volatility. As we sit at the pinnacle of technological advancements in 2023, these innovations are strongly remodeling the global financial landscape. This blog post dives deep into the intricacies of Predictive Analytics and Quantum Artificial Intelligence, exploring how they unlock shrouded patterns, empower businesses with futuristic insights, and revolutionize our perception of market risks.

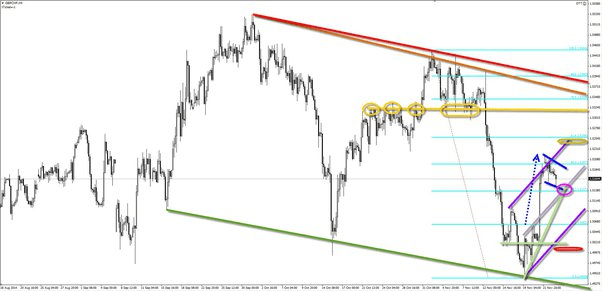

The integration of Predictive Analytics and Immediate Edge to analyze financial data and identify patterns is revolutionizing the world of trading. These advanced technologies can process vast amounts of data at unparalleled speeds, allowing investors to make more informed decisions about buying and selling stocks as well as other assets. This approach enables them to anticipate market trends and volatility with greater accuracy, minimizing risk.

The intersection of Predictive Analytics and Immediate Edge

Predictive analytics has long been a powerful tool for businesses to gain insights into market trends and customer behavior. By utilizing historical data and statistical analysis, predictive models can make informed predictions about future outcomes. However, with the emergence of Immediate Edge, a new dimension has been added to this intersection.

Immediate Edge combines the principles of quantum computing and machine learning techniques to enhance predictive capabilities. This cutting-edge technology harnesses the power of quantum mechanics to process complex data and perform calculations at an exponential speed compared to classical computers.

The marriage of predictive analytics and Immediate Edge promises a leap forward in accuracy and efficiency, enabling businesses to unlock valuable insights and make more informed decisions. To understand how Immediate Edge is transforming predictive analytics, view our recent case studies, offering in-depth insights and real-world applications

Now that we understand the exciting intersection between predictive analytics and Immediate Edge, let’s explore the role of quantum computing in enhancing predictive capabilities.

- According to a report by Allied Market Research, the global quantum computing market was valued at $667.3 million in 2020 and is projected to reach $64.98 billion by 2030, growing at a CAGR of 56.0% from 2021 to 2030.

- A Gartner report suggests that by 2023, 20% of organizations will be budgeting for quantum computing projects compared to less than 1% in 2018.

- MarketsandMarkets research indicates that the market for AI (including machine learning and deep learning) is expected to grow at a CAGR of approximately 35% from 2021 to 2027, reaching about $191 billion by the end of this period.

Role of Quantum Computing in Predictive Analytics

Quantum computing brings a paradigm shift to predictive analytics by leveraging its unique properties such as superposition, entanglement, and interference. These properties allow quantum systems to explore vast solution spaces simultaneously, offering the potential for finding optimal solutions in complex problem domains.

To illustrate this concept, imagine a scenario where a company wants to predict consumer preferences based on various factors like age, location, income level, and purchasing history. Traditional computational methods may struggle with evaluating multiple variables simultaneously. However, through the application of quantum computing algorithms, such as the Quantum Support Vector Machine (QSVM), it becomes possible to consider all these variables simultaneously and derive highly accurate predictions.

Critics argue that while quantum computing holds immense promise for predictive analytics, it is still at an early stage of development. The technology faces numerous challenges ranging from hardware constraints to algorithmic design complexities. Nevertheless, experts remain optimistic about its potential impact on revolutionizing predictive capabilities.

As we venture further into the realm of quantum computing and its role in predictive analytics, it’s crucial to understand how this technology enhances overall predictive capabilities.

How Immediate Edge Enhances Predictive Capabilities

Immediate Edge, with its cutting-edge technology and advanced algorithms, has revolutionized the field of predictive analytics. By leveraging the power of quantum computing, this innovative platform offers enhanced predictive capabilities that surpass traditional methods. With its ability to process large volumes of data and analyze complex patterns, Immediate Edge provides traders and investors with real-time insights into market trends and volatility.

Imagine a trader who wants to predict the future price movement of a particular stock. Using traditional techniques, they might analyze historical data, indicators, and news events to make an informed decision. However, this approach often falls short of capturing all relevant variables in a rapidly changing market.

In contrast, Immediate Edge combines quantum computing with advanced machine learning algorithms to go beyond mere analysis of historical data. It takes into account various factors such as market sentiment, social media trends, economic indicators, and other real-time data sources. This comprehensive approach enhances predictive capabilities by uncovering hidden patterns and relationships that would be otherwise difficult to detect.

Through its sophisticated algorithms and real-time analytics capabilities, Immediate Edge empowers traders and investors with faster and more accurate predictions. By harnessing the immense processing power of quantum computing, it enables users to stay ahead of market trends and make informed decisions in volatile environments.

Decoding Market Trends and Volatility with Immediate Edge

Market trends and volatility are crucial aspects that can significantly impact investment decisions. Traditional methods often struggle to capture the intricacies of these dynamics due to their limitations in data processing speed and complexity. However, Immediate Edge’s ability to handle large datasets enables users to decode market trends and efficiently navigate through volatile conditions.

Let’s consider a scenario where a trader wants to understand the emerging trend in cryptocurrencies. Using conventional approaches, they might analyze historical price movements and news articles related to cryptocurrencies. While this might provide some insights, it may not necessarily capture all relevant factors driving market trends.

With Immediate Edge, the trader can take advantage of its real-time data analysis and predictive capabilities. The platform can process massive amounts of data from various sources, including social media platforms, financial news feeds, and economic indicators. By analyzing this extensive information promptly, Immediate Edge can identify patterns and correlations that influence market trends and volatility.

Armed with these insights, traders can make informed decisions by understanding when to enter or exit positions to maximize their returns or minimize risks in volatile markets.

Using Immediate Edge and Predictive Analytics to Decode Market Volatility

The financial markets have always been known for their unpredictable nature, with volatility being a constant challenge for investors. However, by harnessing the power of Immediate Edge and Predictive Analytics, market participants now have access to advanced tools that can help them better understand and decode market volatility.

Immediate Edge combines the capabilities of quantum computing and artificial intelligence to process vast amounts of data in real time. By analyzing historical market data, current news events, social media sentiment, and various other sources of information, Immediate Edge can identify patterns and trends that might go unnoticed by traditional methods.

Imagine trying to understand the nuances of market volatility by manually scanning through thousands of financial reports and news articles. It would be an overwhelming task, prone to human error and subjectivity. Immediate Edge changes this game entirely by providing powerful computational abilities combined with advanced algorithmic analysis.

By utilizing predictive analytics algorithms, Immediate Edge can make accurate forecasts about future market conditions, including potential spikes or drops in volatility. This allows investors to stay one step ahead by adjusting their investment strategies accordingly.

For instance, if Immediate Edge detects an upcoming period of high market volatility, investment portfolios can be rebalanced to include safer assets or hedging strategies. Conversely, during periods of low volatility, riskier investments could be considered to capitalize on potential profit opportunities.

Now that we understand how Immediate Edge and predictive analytics can help decode market volatility let’s explore how these technologies power investment strategies.

- Immediate Edge and predictive analytics offer powerful tools for understanding and predicting market volatility, providing investors with the means to adjust their investment strategies accordingly. By analyzing vast amounts of data in real-time, Immediate Edge can identify patterns and trends that traditional methods might miss. This allows investors to make accurate forecasts about future market conditions and adjust their portfolios accordingly, improving the chances of success in a constantly evolving financial landscape.

Immediate Edge-Powered Investment Strategies

Traditional investment strategies often rely on historical data analysis and human intuition. However, with the advent of Immediate Edge, new possibilities arise for more effective and profitable investment approaches.

Immediate Edge can analyze vast quantities of data from multiple sources simultaneously, allowing for faster decision-making processes. This means that investors can quickly identify emerging trends or patterns and act on them promptly.

Additionally, Immediate Edge can integrate real-time market data into its analysis, providing up-to-date insights to investors. By combining this data with predictive analytics models, investment strategies can be formulated that take into account both historical trends and current market conditions.

Let’s say an Immediate Edge-powered system detects a surge in social media chatter about a particular company’s upcoming product release. By analyzing the sentiment and volume of these online conversations, Immediate Edge could predict an increase in the company’s stock price. Traders utilizing this information could then adjust their investment portfolios accordingly to potentially benefit from this anticipated price rise.

Investment strategies powered by Immediate Edge also have the potential to mitigate risks through advanced risk management techniques. By continuously monitoring market conditions and evaluating potential threats, Immediate Edge can alert investors to potential risks or suggest appropriate hedging strategies to protect their investments.

Having explored how Immediate Edge is powering investment strategies, let’s now dive deeper into specific profitable investment opportunities identified through this powerful technology.

Profitable Investment Opportunities Identified through Immediate Edge

Immediate Edge, the powerful combination of quantum computing and artificial intelligence, has revolutionized many industries, including finance. Among its notable applications is the ability to identify profitable investment opportunities in financial markets. Traditional analysis methods often struggle to uncover trends and patterns in vast amounts of data within a reasonable timeframe. However, Immediate Edge’s immense computational power and advanced algorithms have proven to be invaluable in analyzing market data to uncover hidden potential.

Let’s consider a scenario where a hedge fund manager wants to identify undervalued stocks with a high growth potential. Using Immediate Edge techniques, they can feed historical market data, company performance metrics, industry trends, and various external indicators into their quantum-based models. These models can then identify patterns and correlations that might elude traditional analysis techniques. As a result, the manager gains insights into investment opportunities that may yield substantial profits.

These capabilities are a result of leveraging the parallel processing power offered by quantum computing and the advanced machine learning algorithms employed by artificial intelligence. By combining these technologies, Immediate Edge helps investors gain an edge in identifying trends, predicting market behavior, and making informed investment decisions.

Having explored how Immediate Edge can unlock profitable investment opportunities, let’s shift our focus to real-world applications of this technology in financial markets.

Real-world Applications of Immediate Edge in Financial Markets

The potential of Immediate Edge extends beyond identifying investment opportunities. It finds numerous real-world applications in the realm of financial markets. One such application is risk management, which plays a critical role in maintaining stable financial systems.

Financial institutions heavily rely on accurate risk assessment to safeguard against unexpected events that could lead to disastrous consequences for both individual investors and the overall economy. Immediate Edge enables more sophisticated risk modeling by processing vast amounts of data and simulating complex scenarios at an unprecedented scale.

For example, by leveraging quantum-based techniques such as Monte Carlo simulations or optimization algorithms, financial institutions can assess the likelihood of different risk scenarios and make more informed decisions. This can include evaluating the impact of market shocks, stress testing investment portfolios, or optimizing risk exposure across various asset classes.

Furthermore, Immediate Edge also holds promise in fraud detection and cybersecurity. Its ability to process massive datasets in real-time combined with advanced machine learning algorithms enhances the speed and accuracy of detecting fraudulent activities. By analyzing patterns and anomalies in financial transactions, quantum-powered systems can alert authorities and institutions to potential threats promptly.

The broad range of applications demonstrates how Immediate Edge is transforming the financial industry, improving decision-making processes, and enhancing security measures.

Research Snipers is currently covering all technology news including Google, Apple, Android, Xiaomi, Huawei, Samsung News, and More. Research Snipers has decade of experience in breaking technology news, covering latest trends in tech news, and recent developments.