The 21DMA is eyeing a rally to $60, while the SOL price has broken above its key downtrend. As ETH price continues to push a higher high, SOL has also violated support at $1400, and XRP has rebounded off its breakout level. The 21DMA has a bullish bias, and the breakout level is a potential buying opportunity for ETH, visit: chesworkshop.org.

After breaking above a key downtrend, SOL’s price has risen above the 21DMA to target a rally to $60. This bullish sign is the first indication that the crypto is poised for another bull run. Ethereum’s price continues to surge as the ETH bulls push it higher. But the bulls need to be patient, as this rally is just beginning.

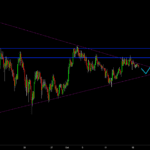

Solana’s breakout above a key downtrend will likely lead to a sharp recovery in June. Since May, the crypto has been painting a falling wedge pattern and fluctuates between two descending converging trendlines. Traditional analysts consider falling wedges bullish reversal patterns, and profit targets are usually based on the distance between the upper and lower trendlines. A breakout in this area could result in a $20 increase.

A Solana (SOL) price breakout could signal a rally in the crypto. The coin closed the week with a gain of 9.5%, having rallied over 30% from its low of $6.35. The technical outlook is not as positive as that of Solana, though, as the cryptocurrency has failed to break above the 21DMA and is stuck below the $8.60 resistance level. Nevertheless, the price may test this level if it continues its rally.

While Bitcoin continues to test the USD 21,000 level, Ethereum price is hovering around $1,150. MATIC is the best performer, up over 13%. Ethereum has surpassed the USD 1,100 and $1,120 resistance levels, and XRP has broken above USD 0.35. In addition, ADA is aiming for an upside break above USD 0.50.

In short, the ETH price has violated the key support of $1400 and now trades at $1236. The next leg down could push ETH to the $1000 psychological support level or the 0.786 Fibonacci retracement level. A bullish pullback could move ETH back towards the $1700 mark. It looks like there is still a bullish trend in the short term, although it has broken through the crucial hedge level for bulls. The bearish spread between the daily and weekly EMAs is still high, indicating that bears are gaining strength.

As a result, market bulls have stated that Ethereum may surpass Bitcoin in the future. Real Vision’s CEO and investor Raoul Pal has claimed that Ethereum’s active role in global blockchain ecosystems could serve as a boost for its price. A break above $1400 would further legitimize cryptocurrencies as an asset class.

XRP price has bounced off its breakout level, reaching the 200-day moving average and the 100-week simple moving average. Moreover, it broke above the important bearish trend line near $0.2950, paving the way for a sharp rise towards the resistance levels of $0.3200 and $0.3500. Additionally, it pushed above the 61.8% Fib retracement level, which may indicate a breakout on the cards.

After avoiding a fall through its Third Major Resistance Level, the XRP price is under pressure as it waits for a ruling on the SEC vs. Ripple case, which could have a material impact on the XRP price. The former Director of the SEC’s Division of Corporation Finance recently stated that Ethereum and Bitcoin are not securities. As a result, it’s safe to buy on dips and expect a 25% rally.

SOL continues to break above the key downtrend, and 21DMA eyes rally to $60. This indicates strong buying interest in the stock, which could lead to a sustained uptrend. This is an excellent opportunity for long-term investors to buy into the stock at these prices. The best way to invest in cryptocurrencies is with the bitcoin trading software. And, It is the best way to gain profits.

Research Snipers is currently covering all technology news including Google, Apple, Android, Xiaomi, Huawei, Samsung News, and More. Research Snipers has decade of experience in breaking technology news, covering latest trends in tech news, and recent developments.