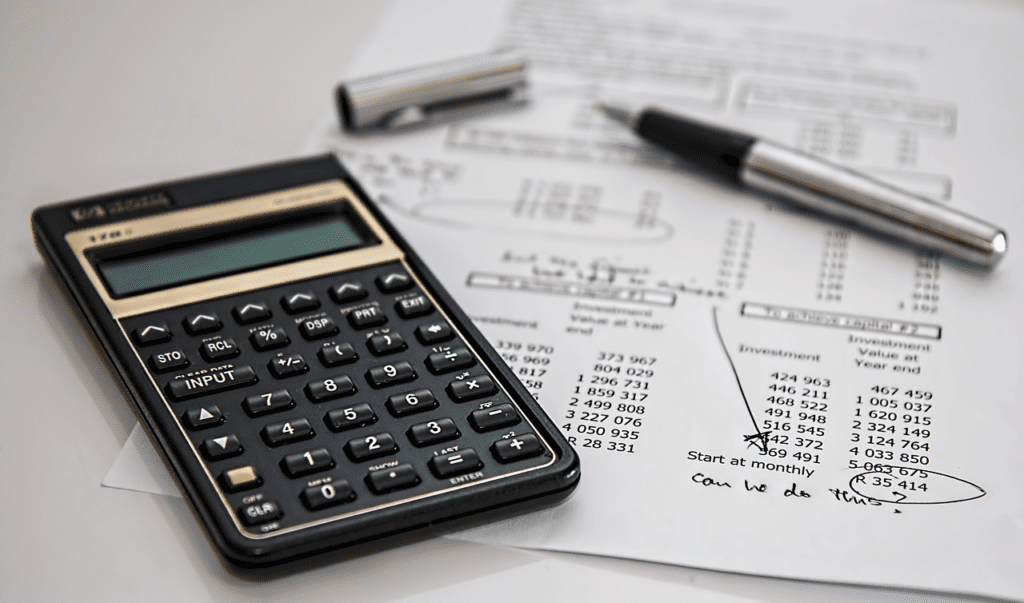

Tax implications of Current Accounts for your business

A Current Account has a higher cash deposit limit. It allows more number of cash withdrawals and transactions. It extends the overdraft facility and provides access to simplified payment solutions. The account is suitable for managing business finances given the feasibility it confers upon.

So, if you are a sole proprietor or an LLP/ private/ public company owner, consider opening a Current Account to streamline your business’ banking and financial needs.

A Current Account is a standard Bank Account; therefore, all banks offer it. Ideally, you should consider opening an account with a bank that provides valuable banking benefits and services at a fair fee and charge.

Taxation is an important aspect to consider when managing a Current Account. The Tax Deduction at Source (TDS) applies to Current Account cash withdrawals exceeding the prescribed limit. This blog discusses TDS on Current Accounts in detail. Read on.

What is the TDS applicable to a Current Account?

Section 194 N of the Indian Income Tax Act elaborates on the TDS applicability to Bank Accounts. It states that the bank will not deduct tax from Current, Savings, or Overdraft Accounts if the withdrawal amount does not exceed ₹ 1 Crore in a fiscal year.

The following pointers decode the applicability of TDS on a Current Account in a simplified manner:

- TDS on Current Account cash withdrawals

According to Section 194 N, you will attract TDS when you withdraw more than ₹ 1 Crore from your Current Account in a financial year. This rule applies whether the amount is from one big withdrawal or the aggregate cash withdrawal amount exceeds ₹ 1 Crore in the same year.

- TDS is calculated per bank

The limit for TDS is set per bank or post office and not per taxpayer’s PAN. This means you attract TDS only when you withdraw more than ₹ 1 Crore from a single bank.

Suppose you hold multiple Current Accounts, each with a different bank. In this case, you can withdraw up to ₹ 1 Crore from each Current Account held with a different bank without attracting TDS. However, note if you withdraw more than ₹ 1 Crore from any of the Current Accounts, you are liable to pay taxes on the excess with that particular account.

What is the TDS rate for Current Accounts?

The TDS rate changes based on the aggregate cash withdrawal amount. Following are all details:

Aggregate cash withdrawals up to ₹ 20 Lakhs:

- For withdrawal amounts less than ₹ 20 Lakhs, no TDS is applicable.

- TDS is not applicable even if you have not filed Income returns for the last three years.

Aggregate withdrawal between ₹ 20 Lakhs and ₹ 1 Crore:

- No TDS shall be applicable if the aggregate cash withdrawal lies between ₹ 20 lakhs and ₹1 Crore. In that case, it is applicable only when you have filed an ITR for the past three years.

- No ITR filed in the last three years: Bank will deduct 2% TDS of the aggregate cash withdrawal amount.

Aggregate cash withdrawal is more than ₹ 1 Crore:

- The bank will subtract 2% as TDS, from the cash withdrawal if it exceeds ₹1 crore. Only if you have filed your ITR for the past three years.

- When you haven’t filed ITR for the three previous years, the bank charges 5% TDS of the total amount.

Bottom Line

A Current Account allows higher cash deposits, withdrawals, and transactions. This helps you manage your business banking and financial needs systematically. If you withdraw over ₹ 1 crore in a year TDS will apply to your account. If you have filed your income tax returns for the three years and have withdrawn over ₹1 crore from the bank account a 2 % TDS deduction will be made on the withdrawal amount. Alternatively, if you haven’t filed any tax returns in the three years the bank will deduct TDS at a rate of 5 %.

Alexia is the author at Research Snipers covering all technology news including Google, Apple, Android, Xiaomi, Huawei, Samsung News, and More.