Taxpayers Data breach: IRS releases personal information

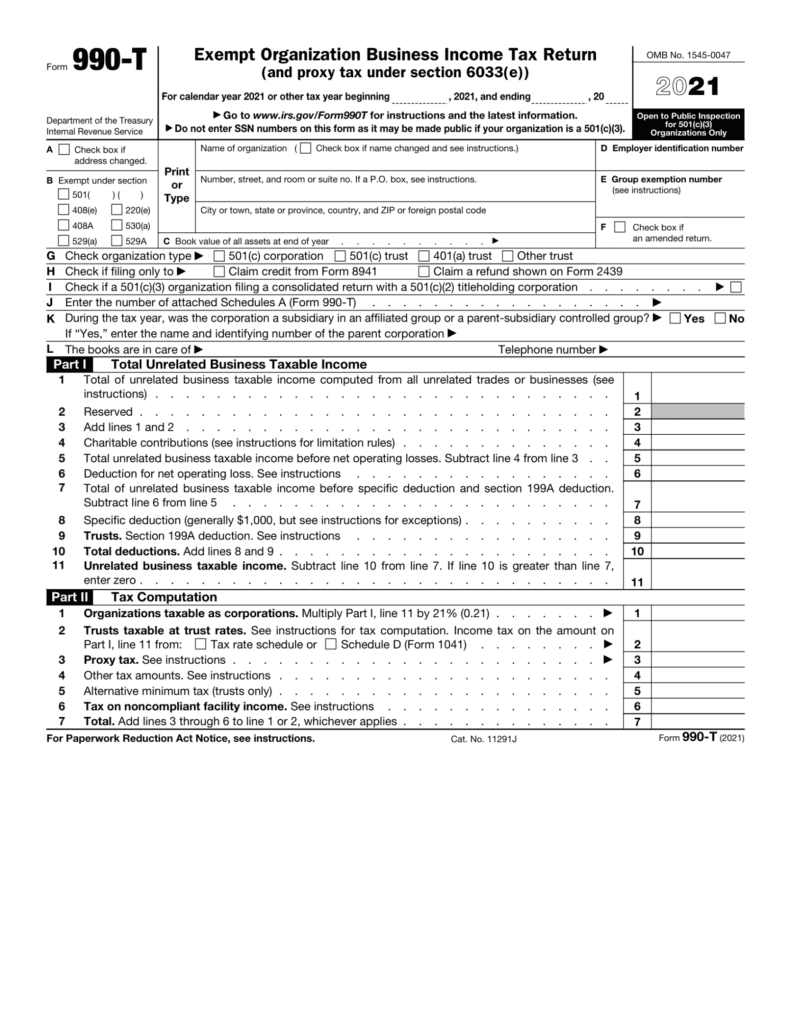

In some cases, those who are taxpayers in the United States must file Form 990-T with their tax returns. If the information comes from companies, it will be made public. Now private data has also ended up on the internet. Form 990-T reports independent business income paid to tax-exempt entities, charitable organizations, and some retirement accounts.

As bleeping computer reports most of the revenue comes from sales that are not related to the main purpose of the organization. In addition, the investment property declaration forms are used in connection with an individual pension account. While nonprofits are required to make the form public for three years, information provided by individuals is viewed only by the IRS.

On Friday, however, the IRS had to disclose that the forms were not only uploaded by nonprofits and offered for download on the website. About 120,000 undisclosed tax records have been released. The leaked records include real names, contact details and taxpayers’ reported income. However, social security numbers, tax refunds or account details have not been leaked.

Affected taxpayers will be contacted shortly

After the error became known, the authority removed the relevant files from the official website irs.gov. In addition, the affected applicants will be contacted and informed about the data breach in the coming weeks.

Research Snipers is currently covering all technology news including Google, Apple, Android, Xiaomi, Huawei, Samsung News, and More. Research Snipers has decade of experience in breaking technology news, covering latest trends in tech news, and recent developments.