Tech’s Worst Week Since April: AI Sector Loses $800 Billion

Tech stocks are having their worst week since April. AI companies lost about $800 billion in market value. Some experts see this as the beginning of a bursting bubble, others just assume a correction of overheated valuations.

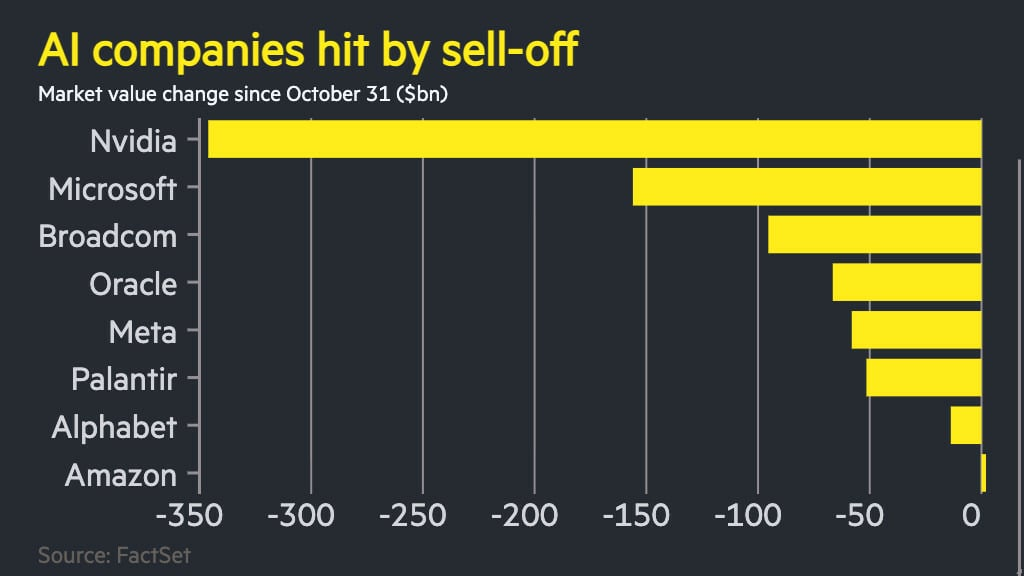

AI stocks on a dramatic decline

The Bank of England and other experts had already warned of a bubble bursting. After a record rally, AI-related companies have now lost $800 billion in market value in the past week. Nvidia was hit particularly hard, losing around $350 billion in value alone.

Microsoft lost over 150 billion, while Meta and Oracle also suffered significant losses. When Donald Trump shocked the markets last April with tariff announcements, the Nasdaq had already recorded similar losses. Now the high valuations of many AI companies seem to be unsettling investors. Some voices speak of the beginning of an AI bubble bursting.

Warning signals from the financial world

According to the Financial Times The four tech giants Alphabet, Amazon, Meta and Google invested a total of $112 billion in AI infrastructure in the third quarter. However, these enormous expenses are increasingly being financed through loans. Such behavior reminds some experts of the disastrous dot-com bubble of 2000. The parallels to events at the turn of the millennium are disturbing.

Back then, excessive expectations of the Internet led to a speculative bubble that eventually burst, wiping out trillions of dollars. Many companies that were never profitable reached astronomical valuations before reality set in. Today, critics see similar patterns in AI companies that are highly valued despite lacking sustainable business models. Even OpenAI is making enormous losses.

Extreme ratings under fire

The valuations of many AI companies have now reached dimensions that make even optimistic investors ponder. Palantir, for example, is valued at 200 times its forward earnings. This corresponds to a level that has historically only been reached in extreme bubbles.

Added to this are weak economic data, which is further weighing on sentiment. The University of Michigan Consumer Confidence Index fell to a three-year low, raising doubts about the sustainability of consumption growth. The ongoing budget crisis in the USA is further increasing the uncertainty on the markets and making investors more nervous.

China stirs up doubts

Added to this is the rapid technological progress of Chinese AI developers. Moonshot AI’s new Kimi K2 Thinking model reportedly cost less than $5 million to develop, a fraction of what Western competitors often spend billions on similar projects. This apparent cost efficiency calls into question the justification for the enormous spending by American tech companies.

Even the so-called “DeepSeek moment” in January 2025, when a low-cost Chinese AI model shook markets, cost Nvidia $589 billion in market value in a single day. The incident demonstrated how quickly the balance of power in the AI industry can shift and how vulnerable the highly valued US companies are to technological breakthroughs from competitors.

Experts warn of correction

While some analysts warn of a correction of ten to twenty percent in the next two years, others remain calm and see the current developments as an overdue market shakeout. The question is no longer whether a correction will come, but when and how strong it will be.

The AI euphoria could slowly give way to reality. What do you think – is this a healthy correction or the start of a larger crisis? Share your assessment in the comments! See also:

Digital marketing enthusiast and industry professional in Digital technologies, Technology News, Mobile phones, software, gadgets with vast experience in the tech industry, I have a keen interest in technology, News breaking.