How to Create a Future Financial Plan

Financial Goals and Planning: Basic Things You Need to Know

We all have aspirations in life, such as establishing a company, purchasing a home, and getting married, but money issues sometimes sabotage these endeavors.

One of the best methods for ensuring future success and financial security is to set financial objectives. A financial plan is the first step in achieving your largest lifestyle or legacy objectives. Financial planning essentially entails figuring out how to make money, how to save it, and how to spend it, as well as how much you need to make, invest, and spend.

The issue is that it’s simple to become bogged down without clear financial objectives and a plan for managing your budget. Learn about financial planning, financial objectives, and how to develop and meet important financial goals in this article.

What Exactly Are Financial Objectives?

Your financial objectives are the amounts you want to save, invest, or spend over a certain period. What kind of objectives you want to attain often depends on the stage of life you’re in.

Setting financial goals gives you a clear vision of what you want to achieve and makes it simple for you to take action to get there. We all have various financial objectives as a result of our differences. Saving and investing are important to keep in mind while trying to reach a financial goal, especially if you have loans in apps that loan you money or debt to friends or family.

A Financial Plan: What Is It?

By creating a road map to get there, financial planning is a practical approach to arranging your financial condition and objectives. You should think about what you presently have, your long-term ambitions, and what opportunity costs you’re prepared to accept to achieve your financial goals when choosing where to start.

Creating a plan today may help you go ahead in the long term, whether you’re a future billionaire or still in college. Financial planning is a wonderful technique for everyone to achieve their financial objectives.

What Steps are Included In Personal Financial Planning?

Describe Your Financial Objectives

The first step in creating a financial strategy is to decide precisely what you want to achieve. Start by going through potential short- and long-term objectives. One of them may be making a down payment on a home, clearing your debt, or purchasing a brand-new vehicle. These objectives will serve as the main inspiration for your financial strategy.

Outlining these objectives should take your financial future into account as a whole. Don’t simply concentrate on one part of your money since everything is related. When it comes to family planning, for instance, you may want to consider both creating a college savings fund and making a down payment on a property.

Prioritize Your Objectives

Prioritize your savings objectives to fit the various periods of your life now that you have an idea of the kind of life you want to create over the following thirty years. Your priorities may be as follows if you are saving for a future that includes a mortgage, children, and retirement:

- Put money aside for a down payment on a house;

- Save for supporting your kids;

- Plan ahead for retirement.

Naturally, some of these priorities may cross paths. It is possible to save for your children’s trust funds and your retirement at the same time, but you should prioritize your children’s requirements since they will likely need assistance before you retire. Your personal financial planning objectives may be prioritized as follows: start saving to get out of debt and start saving for early retirement if, for instance, you wish to get out of debt and retire early.

It’s advisable to start saving as soon as you can since early retirement demands a significant amount of money. In this case, saving for an early retirement starts the moment you are debt-free.

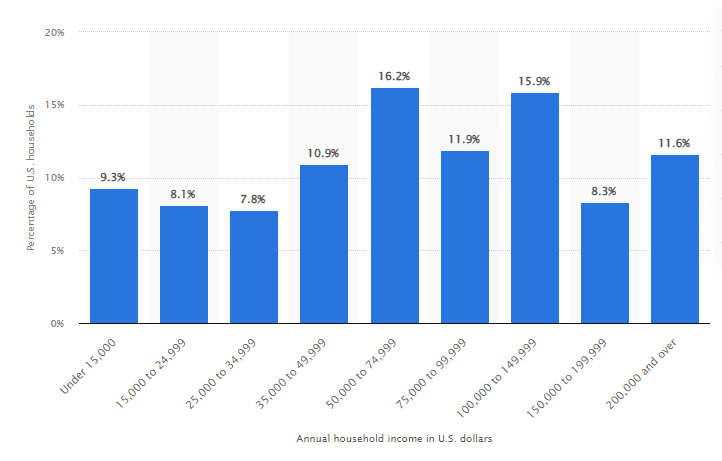

A little over 52% of Americans in 2021 had an annual household income of fewer than 75,000 dollars. In 2021, the median household income rose to $71,784. Even if you earn less than average, with the right financial planning, you can still achieve your financial goals even if it takes a little longer.

Make a Strategy for Your Debts

Nobody likes thinking about debt, but if you want to be financially intelligent, you must deal with these difficulties. Financial personal planning might be useful.

If your interest and payback obligations are keeping you from moving forward, you won’t be able to achieve your short- and long-term objectives. Determine how you will pay off your debts first.

Make a strategy by analyzing cash flow to pay off your most difficult loans first. Due to exorbitant interest rates and fees, these charges are the most expensive. Remove them as quickly as possible.

See if you can combine all of your loans into one, less expensive loan if you’re having trouble managing many payments at once.

Boost Your Credit Score

It’s always advantageous to be eligible for a reduced interest rate when applying for a mortgage or any other loan. Simply said, having a higher credit score entitles you to cheaper interest rates, which saves you money.

Establish a Budget

Making a budget may help you figure out how to make a financial plan and reach your long-term financial objectives. You can determine where you can afford to spend your personal income and where you should be conserving when you make a budget and follow it.

The 50/30/20 guideline is an excellent and easy strategy to reach your financial objectives. By following this guideline, you may keep yourself on pace for financial success while incorporating your objectives into your budget. It’s critical to have an updated budget and a strategy in place to reach any financial goal you have.

Conclusion

The easiest way to accomplish your financial goals is to create a plan that prioritizes your goals. You’ll discover that some of your objectives are comprehensive while others are more focused and limited in scope.

A financial plan enables you to manage your finances sensibly and make long-term plans. Though creating a strategy can require some effort and time, it will probably be worthwhile in the long run. As a result, you and your family will have a clearer route to the future.

Research Snipers is currently covering all technology news including Google, Apple, Android, Xiaomi, Huawei, Samsung News, and More. Research Snipers has decade of experience in breaking technology news, covering latest trends in tech news, and recent developments.