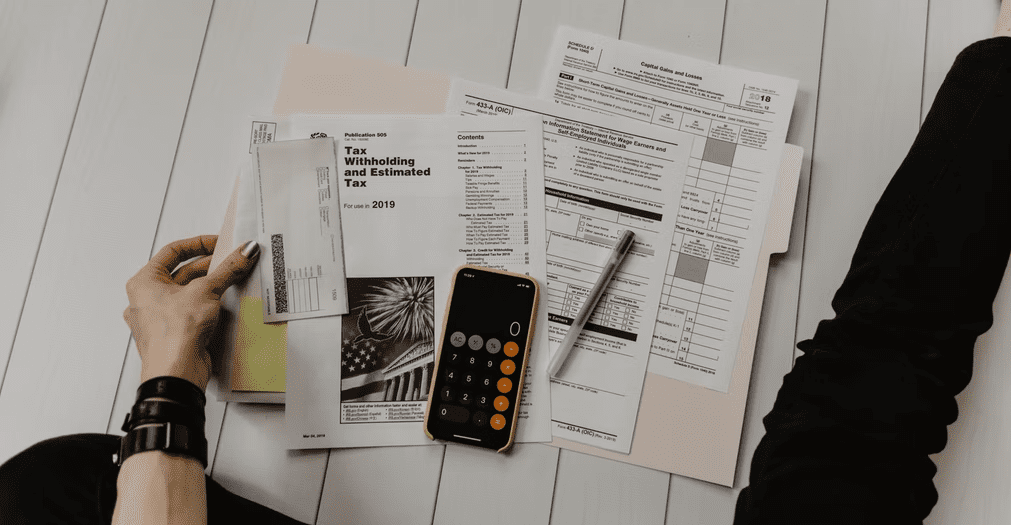

All You Need To Know About A 1040 Form

A 1040 Form is What?

These forms are distributed by the IRS to each and every person who must submit a federal income tax return on an annual basis. All citizens of the US are required to submit IRS Form 1040 when filing their taxes.

The 1040 tax: What You Need to Know

Taxpayers are extremely confused as a result of the IRS’s modifications to the 1040 forms. To make things obvious, read this post.

What modifications should we first note?

The IRS revised the 1040 forms to follow suit with the Tax Cuts and Jobs Act. The adjustments comprise:

-Personal exemptions are no longer allowed.

-The standard deduction is decreased.

-The higher income thresholds that must be met before paying more taxes.

A tax credit of up to $500 is also available for dependents who are under the age of 17 under the new tax law. However, if the parents claim itemized deductions on their tax return, the kid is no longer entitled to the extra tax.

The impact

Personal exemptions are no longer allowed, which is the main difference. Contrary to popular belief, itemizing deductions is not presently required for the taxpayer, as many people believe. If the taxpayer chooses to itemize, the personal exemption is still valid.

The reduced standard deduction is the other significant change. The standard deduction is decreased from $24,000 to $6,000 under the new law. The increased tax will thus apply to fewer taxpayers.

The new legislation also boosts the income criteria for the extra tax. It will thus affect fewer individuals. As an illustration, the prior cap for single taxpayers was $1 million. The cap has been raised to $1.2 million for single taxpayers and $2 million for joint filers.

Overall, the standard deduction was decreased, the personal exemptions were withdrawn, and the income threshold for the extra tax was raised on the new 1040 forms.

How does a 1040 tax work?

Let’s look at 1040 first, though, before we continue. A tax return is what it stands for.

Every American citizen must complete Form 1040 tax each year. Additionally, each year we receive a 1040 tax return that lists all of our earnings and outgoings for the preceding fiscal year. Personal earnings and capital gains are also included in this.

As a result, whenever you file, you could be startled to discover that, unless you itemize, there is no federal tax owed on your income.

You can deduct your income if it is greater than the standard deduction, which in 2017 is $6,400 for individuals, $9,400 for couples, and $13,750 for heads of household.

Mortgage, insurance, and charitable contributions are just a few of the other deductions you might list on your 1040 tax return. You could have to pay various taxes on top of your 1040 tax return.

In order for you to claim your income on your taxes, for instance, your employers must file the 1099-DIV form. To claim any rental income on your taxes, your landlords must file the 1099-K form.

A variety of 1040 taxes

Paper forms are acceptable for filing. The forms can also be completed and sent to the Internal Revenue Service online using the My1040 website. The 1040 tax form may also be submitted through a smartphone.

The 1040 tax form may also be submitted using a smartphone. Even though it can appear cumbersome, submitting online forms is far quicker than doing so with paper ones. To submit your 1040 taxes online, you should research your options.

The 1040 form-filling process

New guidelines for completing Form 1040, Form 1040 ES, and Schedule SE have been published by the IRS. Additionally, we have gathered all the information you want in case you want to file your taxes by the April 15 deadline.

1. Transmit documents online

You may file electronically if you utilize e-file by utilizing your tax preparation software or the IRS website. Additionally, faxing or mailing your taxes are options if you don’t want to use e-filing.

2. Store paper documents

If you’d want a printed copy of your 1040 form, you may accomplish so, but you will need to fill it out manually.

3. Employ an outside preparer

In the event that you are filing online, you can also hire a third-party preparer. Finding someone who is qualified and registered with the IRS is necessary, but doing so will save you money and time.

4. Construct it yourself

Tax preparation is achievable if you are comfortable with it, however, it could take a little more time. While using a computer may make this task simpler, it is not essential.

5. Publish by hand

It is preferable to submit your taxes before the April 15 deadline if you want to avoid a late penalty. By employing a third-party preparer or by completing the form and mailing it in, you may accomplish this.

Conclusion

Each year during filing season, there are several forms that need to be completed, regardless of whether we need to file with the IRS or another organization. Form 1040 is among the most significant documents. With the use of this form, we can figure out our taxable income and subtract our out-of-pocket costs. A 1099 tax calculator can always help with your tax filing needs or you can use an app like FlyFin, that uses A.I. to find deductions. In order to efficiently complete the 1040 form, it is crucial that we keep a record of our transactions and the data we possess.

Alexia is the author at Research Snipers covering all technology news including Google, Apple, Android, Xiaomi, Huawei, Samsung News, and More.