For decades, the games industry was significantly smaller than other leading media sectors such as the film or music industries. Yet at the outset of the millennium, something significant occurred – the games industry began to experience phenomenal and sustained growth that has not abated even today.

Why is this? In truth, there’s likely a huge range of reasons why this would come about. For one, the market clearly hadn’t reached a saturation point, something that those comparable industries had reached decades previously.

There’s also something to be said about changing preferences. Those with the greatest share of disposable spending power in society today were raised with video games as a much more overt part of their lives than previous generations.

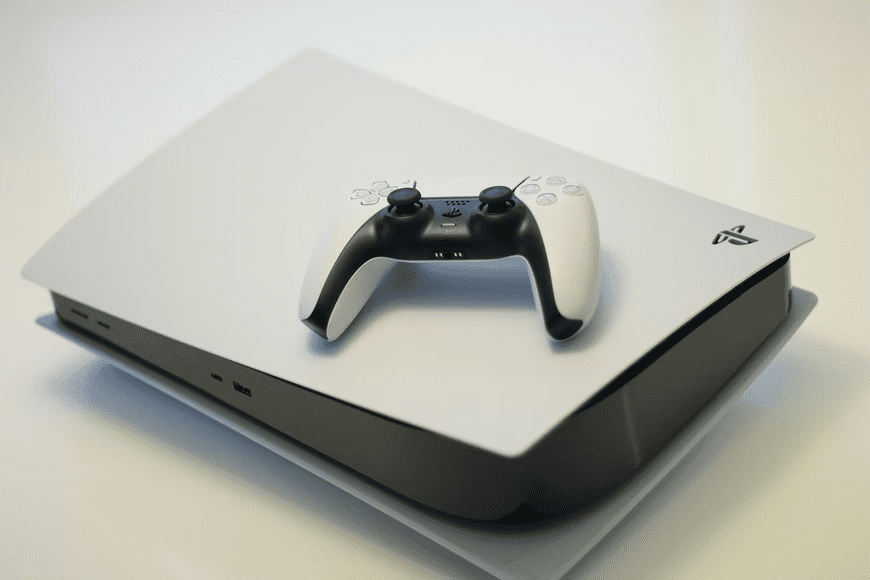

This has led to the playing of games as adults, something which once held an unfair stigma, being normalized and legitimized. Whereas comparable consumers in the 90s may have spent their hard-earned on a new VHS player, today people are much more likely to invest in a new game console.

Another key change has been the way games are monetized, with the implementation of microtransactions proving particularly lucrative for developers. As a result of these factors, the industry has grown massively – in fact, it’s now 5 times larger than the music and film industries combined, commanding a global revenue of over $180 billion at present.

This picture is much the same in Canada, being a westernized and developed economy, Canadians are partial to using their spending power on luxury consumer electronics. The market concerning consumer electronics in Canada is currently valued at around $14 billion, and dedicated games consoles occupy around 24% of this, up from 19% in 2019.

In this article, we’re going to take a look at the most popular gaming services among Canadians in 2022 to get an overview of a changing picture.

Canadian Console Market Share

Back in the 90s and early 2000s, it was common to talk about the “console war” among gaming fans. First, there was a rivalry between Sega and Nintendo, then with the arrival of the first PlayStation, Sony became Nintendo’s key competitor.

With the dawn of the millennium, Microsoft entered the fray and quickly pushed Nintendo into irrelevance in the Triple ‘A’ space. The progressive iterations of Sony’s PlayStation and Microsoft’s Xbox consoles have established the landscape for developers and the wider gaming community right through to the present day, though few speak of a “console war” anymore.

With major developers producing titles cross-platform releases, and the wider industry growing more interconnected, the two platforms now, while still in the competition, are no longer vying to monopolize the space.

Yet depending on which market you look at dictates which platform has an edge. In Japan, for example, the Xbox has never managed to gain a realistic foothold, leading Sony to dominate its domestic market alongside Nintendo.

In Canada, the Xbox’s market share has dropped off significantly from a high of 54% in August 2021 to 10% today, with Sony’s new PlayStation doing extremely well and now holding around 89% of the market share.

A Broader Picture Beyond Console Hardware

While console penetration in Canadian households currently sits at around 42%, over 82% of Canadians own a smartphone. As such, for most, smartphones represent the most accessible means of playing games.

One key sector that has experienced growth as a result of this greater smartphone penetration in Canada is the iGaming market, which is now valued at around $30 billion as of 2021.

Following a wave of landmark legislation in the United States that has created a far more welcoming climate for platforms and providers operating in this sector, Canada has sought to follow suit in adjusting its legal framework to connect Canadians with iGaming platforms more easily.

Furthermore, leading platforms in the sector such as VegasSlotsOnline are facilitating this process by serving as a comparison directory listing the best online casinos Canada has to offer.

With a range of carefully selected providers listed on these directories alongside a host of competitive sign-up bonuses and welcome offers, all signs point to the climate towards this sub-sector thawing significantly, a trend we can expect to see increase domestically over the rest of the 2020s.

Elsewhere across the smartphone gaming market, we are witnessing a maturation in the app-gaming market. While the majority of titles on offer on both the App Store and Google Play Store are so-called “hyper-casual” experiences, this is also seen to be changing. Increasingly developers are producing console-grade ports for the platform, and with the arrival of cloud gaming Canadians can now experience top-tier gaming experiences through their smart devices, even while on the go.

Alexia is the author at Research Snipers covering all technology news including Google, Apple, Android, Xiaomi, Huawei, Samsung News, and More.